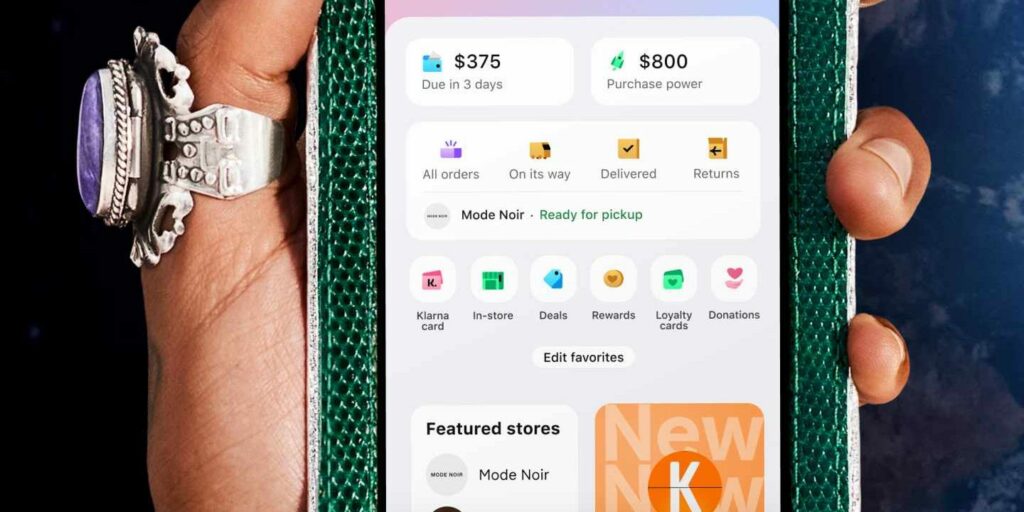

Imagine this: the gadget that would improve your productivity at work has just been released, and you just got to have it. You don’t have the money yet, but you don’t have to worry about that, because you are a long-time user of the leading Buy Now Pay Later app: Klarna. But then, as you proceed to check out, you suddenly realize that your purchase power dropped. If you’re puzzled as to why this had to happen and you need answers right away, keep reading.

Why was my Klarna purchase power dropped?

There are several reasons why even Klarna users’, and even long-time Klarna users’ purchase power would drop, and here are some of them:

Reason #1: Late or missed payments

If you fail to make a payment on time, your Klarna Purchase Power will be automatically suspended until the outstanding balance is paid. And then, there would be a high possibility that your purchase power would drop.

Reason #2: Credit issues

If a customer’s credit score or financial situation changes, Klarna may limit their ability to use their services, hence the change in their purchase power. So if you experience a sudden drop in your purchase power in this app, you might want to sort your credit out first.

Reason #3: Suspicious activity

Klarna has iron-clad rules and regulations with regard to Data Privacy and Fraud Prevention. If Klarna detects suspicious activity on your account, they have the right to automatically flag your account for fraudulent activities, decrease your purchase power, or ultimately prohibit you from using their services.

If you are experiencing financial difficulties or are unable to make payments, it is important to contact Klarna as soon as possible to discuss their options. Klarna may be able to offer a payment plan or other assistance to help the customer get back on track.

How do I get my purchase power back on Klarna?

If your purchase power on Klarna has been reduced or restricted, there are a few steps you can take to try to get it back:

- Make sure your payments are up to date: If you have missed payments or have outstanding debts with Klarna, your purchase power may be reduced or restricted. Make sure all of your payments are up to date and any outstanding debts are paid off.

- Contact Klarna customer service: If you’re unsure why your purchase power has been reduced or restricted, or if you believe it was done in error, contact Klarna customer service. They may be able to provide more information and help you resolve the issue.

- Build your credit score: Klarna may use your credit score to determine your purchase power. Improving your credit score by paying bills on time and reducing your debt can help increase your purchase power.

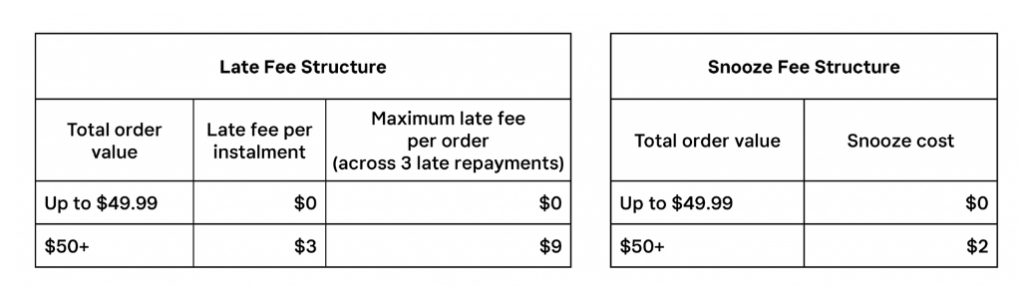

- Use Klarna responsibly: Klarna may also consider your past behavior when determining your purchase power. Using Klarna responsibly, such as making payments on time and avoiding missed payments or late fees, can help build trust and increase your purchase power over time.

Keep in mind that Klarna’s policies and procedures may vary depending on your location and the specific terms of your account. If you’re still having trouble getting your purchase power back, contact Klarna customer service for assistance.

Is there a maximum purchase power on Klarna?

Yes, Klarna does have a maximum purchase power that varies depending on the user’s creditworthiness, location, and the specific terms of their account. The maximum purchase power for their Pay in 4 services is $1000 and they offer up to $10000 if you are currently looking at financing a purchase.

Klarna’s maximum purchase power can be influenced by several factors, including the user’s credit score, payment history, and overall financial health. Additionally, different Klarna payment options may have different maximum purchase powers.

It’s worth noting that just because a user has a high maximum purchase power does not mean they should necessarily use it. It’s important to only borrow what you can comfortably afford to pay back and to use credit responsibly to avoid getting into debt.

In conclusion

The reason why your purchase power dropped in Klarna might be because you have missed a payment, you are having credit issues with other companies or with your bank, or your account has been flagged for fraudulent behavior. This might be a piece of unfortunate news for you, but you can always talk to their customer support to have this issue fixed.