Money-Saving Tips and Tricks for 2023

Contents

We all want to have enough money to live comfortably and achieve our goals, but sometimes it can feel like it’s not possible as we may be in a cycle of earning just enough to get by. Fortunately, there are many ways to save and build a more stable financial future. Stay tuned, because we are going to explore some of the most effective money-saving tips and tricks for 2023.

Travel Hacks

Traveling is not only a way to visit thrilling new places but also an excellent way to unwind and relax your mind. While it’s expensive, we can’t still ask you to exclude all travel from your budget plans, but we can show you how to save money on your future trips:

Take advantage of lower flight and accommodation price rates by booking early. Also, consider traveling during the off-season like during January, when prices are normally lower.

You can also use websites and apps for instance Airbnb to find the best transport, flight and accommodations deals with discounts. Travel credit cards are another great way to save money on travel as they offer rewards points for travel-related purchases, which you can later redeem for free flights and hotel stays.

Saving on food and activities while traveling can also help you save money. Look for local favorites and food stands, which are often cheaper than touristy restaurants. Consider taking advantage of free activities, like hiking or visiting local museums.

Cut Down on Expenses

One of the most straightforward ways to save money is to reduce expenses. The first step is to identify unnecessary expenses – we can spend a surprising amount on things we don’t need. Determine where your money is going by looking at your bank statements. Check if you are paying for a subscription you don’t use, eating out too often, or buying things you don’t need? Once you know, you can start making changes.

Budgeting is another crucial tool for cutting down on expenses. Set a realistic budget for your monthly spending and stick to it. It might mean cutting back on some luxuries but it will pay off in the long run. Comparing prices between different retailers and considering generic brands instead of name brands can help.

Limiting how often you eat out can save you hundreds of dollars each month. While it’s nice to go out for a meal now and then, it can quickly add up. Instead, try cooking meals at home and packing your lunch for work or school.

Use Coupons and Discounts

Another way to save money is by taking advantage of coupons and discounts. You can start by looking for coupons and loyalty discount programs for the things you buy regularly. You can also install browser plugins, such as Honey, to do this for you every time you shop online. Cashback apps are also a great way to save money, giving you cash back for purchases at specific retailers.

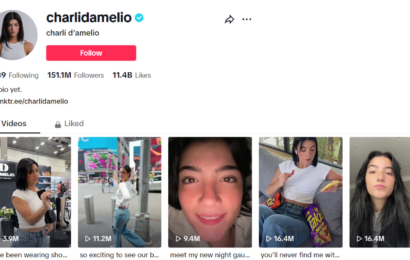

Following your favorite brands and retailers on social media can also be an excellent way to stay updated on their latest deals and discounts.

Energy Saving

Energy and water bills can quickly add up, but plenty of ways exist to reduce them. For example, install energy-efficient light bulbs and appliances and turn them off when not in use. These actions can contribute to big savings on your monthly energy bills.

Reducing your water bill can be as simple as taking shorter showers and fixing leaks around your home. Alternative energy sources, such as solar panels, can also help reduce your energy bills. Installing solar panels may be a big initial investment but they can drastically reduce your monthly bills in the long run.

Home improvements for energy efficiency can also help you save money. For example, adding insulation and installing a programmable thermostat can reduce your heating bills.

Financial Planning

Saving money is not just about cutting down on your expenses; it’s also about planning perfectly for the future. By wisely investing your income is among the best ways to grow your wealth. Consider speaking with a financial advisor to learn more about various best investing strategies that work for you because what works for others might not work for you. Retirement planning is also critical, so start saving for retirement early to take advantage of compound interest rates. Emergency funds are another essential part of financial planning, and having a perfect emergency fund like health insurance can help you avoid debt in the event of an unexpected event like sickness or accident.

If you have children, save for their college education and health. Consider inquiring with your trusted best national bank about their savings plan or other college savings account to help cover the cost of tuition for your kids.

Conclusion

Saving money can be challenging, but it’s essential for achieving financial stability and security. Cutting expenses using the above strategies can save you a fortune. These funds can then go towards your choice of investment, or savings plan each month. Remember to set realistic goals and be consistent in your efforts to save money. You can build a solid financial foundation for yourself and your family with discipline and patience.