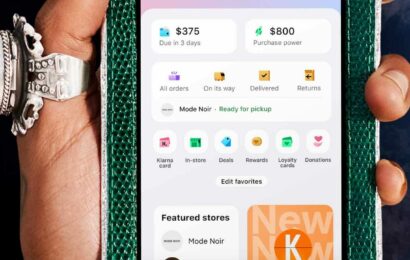

Klarna is a Swedish financial technology company affiliated with 7,500 stores in the U.S. like Amazon, Nike, Lenovo, Sephora, and many more. It is a convenient way to pay online with your bank account. It is a fast and hassle-free fintech innovation that offers buy-now-pay-later online financial services such as storefronts, online payments, direct payments, and post-purchase payments.

Not only do you use Klarna to pay for your purchases, but also you get cash from it. How to get cash from Klarna? There are several ways to do it, such as:

- Online money transfer. At your fingertips, you can send money from your bank account to your loved ones and receive it in cash.

- Cash-out through a partner agent, like Western Union.

- Klarna visa debit card. Klarna Banking issues Visa debit cards, which you can use to withdraw cash at any Visa ATM anytime, anywhere.

Can I withdraw cash from Klarna’s Card?

Klarna Bank Card comes with your bank account and a visa debit card. You can use it to pay online and withdraw cash twice a month. However, don’t get confused with Klarna Card because Klarna Card does not allow cash withdrawal but only provides payment options like financing your purchases. If you opt to use Klarna with your bank account and a visa debit card, here are a few steps on how you do it:

Step-1: Log in to the Klarna app

Step-2: On Bank & Card, fill out the application form

Step-3: Confirm identity using Klarnaldent or Videoldent

Step-4: Set up your pin code

Step-5: You can now choose your Klarna Bank Card design

Step-7: Then, you can start sending money to your Klarna

How do I withdraw from Klarna?

Withdrawing money from Klarna is very easy. To withdraw cash from Klarna:

Step-1: Get a free Klarna Banking issued Visa debit card

Step-2: Go to any ATM that accepts a Visa card

Step-3: Insert your Klarna debit card into the machine and enter your pin code

Step-4: Start withdrawing your desired amount

Even though Klarna banking allows you to withdraw money, keep in mind that you can withdraw money from any ATM in Germany and abroad twice per month. After that, you’ll be charged 2 € per withdrawal. Klarna apply the following cash limit for withdrawals:

- Max 1,000 € per attempt

- Max 1,000 € per day

- Max 2,500 € per week

You can always request a card since it is easy and free of charge with no running fees. Klarna will deliver your card to the address you have confirmed upon signing up within seven business days. Once you have it, you can activate it in the app, atm accepting visa card, or connect it with Apple Pay or Google Pay. But, if you did not receive the card after seven days, block the card right away through the app. You can always request a new one for free.

Can you borrow money from Klarna?

Klarna also offers a credit option called monthly financing. It acts as a traditional loan process that charges a 0% to 29.99% annual percentage rate. It is a credit option offered at the checkout of any partnering store and allows you to spread the cost from 6 to 36 months. The company gets its cash by crediting the seller rather than the consumer. The plan varies based on the customer’s financial details such as credit score, how long you’ve been using Klarna, and loan payment records with Klarna. Once approved, you can purchase as much as $10,000. The steps are simple in order to avail of the financing option in Klarna:

Step-1: Sign up for a Financing account in Klarna

Step-2: You will receive an email confirmation from Klarna and your credit limit. You can now use it on your next checkout.

Step-3: Select to pay later with financing upon check out of your order

Step-4: Choose the term length that is most convenient for you.

Step-5: Complete the purchase.

Always remember to pay on time to avoid a penalty for late payments. Klarna charges up to $35 for late payments.

Can you transfer cash to another bank from Klarna?

Yes, you can transfer cash to another bank from Klarna. Klarna is a fast and easy payment option that allows you to send cash from your bank account in minutes. There is no need to register a new account, nor have a credit or debit card just to send money to your loved ones. In just a few steps, you’d be able to move money to any recipient bank account using Klarna:

Step-1: Select Klarna as the payment method

Step-2: Choose your bank and country

Step-3: Log in with your banking details. Make sure your banking details match your Klarna information.

Step-4: Enter the confirmation code for your transfer, then you’re done.

And since you can only send money in Euro, always check with the recipient bank if they allow incoming Euro transfers.