Online financial services like Klarna are handy for individuals who can’t fully pay for their desired item. Some of them are also looking forward to paying for more items but are unaware of the limits of Klarna. Sometimes, the initial limit set by Klarna may not be sufficient for your needs. Read on to find out how to increase your Klarna limit.

Increasing your Klarna limit is possible through a request. However, Klarna will not allow most requests to encourage responsible spending among its users.

Also, the restrictions from Klarna are tighter for newer users. Restrictions will gradually decrease over time if the user gains Klarna’s trust. Only by then, the chances of increasing the limits of Karna’s service can be improved. However, there’s still more chance of purchase limit removal rejection.

Can You Increase Your Limit on Klarna?

No, you can’t increase your limit on Klarna. At least without their approval, that is.

Klarna does not impose a specific limit when it comes to credit limits and spending. However, the limits will take place only during purchases.

You can attempt to purchase beyond your credit limit, but you will still need Klarna’s approval to complete it. Also, there’s no other way to see the credit limit until an attempt for purchase is made.

Also, they won’t approve all orders to encourage safe spending. They also said that they support responsible, ethical, and sensible spending habits for the same reason.

Increasing the limit is also not solely based on a user’s credit information. The possible deciding factors for their approval are the user’s past payment history, the time of the purchase, and the total price or amount.

What is the Max Klarna Limit?

The max Klarna limit only applies to purchases with fixed installment plans. There’s no definite max Klarna limit because users’ purchases are all different from each other.

The recommended route for Klarna users is to assess their budget for the long term. Also, spending more than you can afford is not a wise choice.

A possibility of additional fees may happen if a user happens to spend beyond the limits. However, it will rarely happen because Klarna can limit it based on the situation.

However, some approved Klarna users are more likely to overspend. It is most probable that some of them can underestimate the total amount of their spending.

Still, the max Klarna limit will mostly depend on the user’s spending habits and how Klarna will assess a specific purchase.

How Do I Find Out My Klarna Spending Limit?

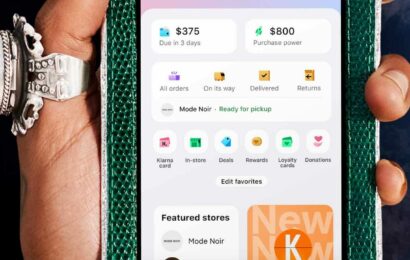

There are instances wherein the Klarna mobile app, a text that tells the user the estimated available spend will appear. Beside the text is the numerical amount of the spending limit allowed by Klarna.

However, important information will not always appear. Some new Klarna users are surprised and think the app is bugged and full of errors.

Since there’s no fixed amount spending limit in Klarna, they will instead limit their spenders depending on an item. It means that if your purchase using Klarna is approved today, it is more likely that it will not be the same the next time you purchase.

For Klarna app users that they approved for purchase, the text and the spending limit allowed will be available and can be seen at the top-center of the mobile app’s page. You will know that your purchase is not approved if no such text and numbers show up.

How Can I Increase My Klarna Limit?

Increasing your Klarna limit takes consistent effort, time, and even luck. Klarna will always be the one who will decide if they will allow you to increase the limit. Here are some strategies and tips to help you increase your Klarna limit.

1. Pay Your Klarna Bills Promptly

One surefire way to increase your spending limit is to gain Klarna’s trust. You can build trust and reliability with Klarna by paying your Klarna bills promptly.

Late payments can negatively impact your creditworthiness and may hinder your chances of increasing your Klarna limit. Set reminders or automate payments to ensure you never miss a due date.

When Klarna sees you as a reliable person who pays on time while being on their platform for months or years, it is more likely that they will approve increasing your Klarna limit.

2. Increase Your Income

Your income plays a key role when Klarna assesses your creditworthiness. If your income has increased since you first applied for Klarna, consider updating your income information to reflect the change. Klarna may be inclined to give you a higher limit if you report a higher income.

3. Build a Positive Payment History with Klarna

Consistently making on-time payments and maintaining a positive payment history with Klarna can work in your favor when it comes to increasing your Klarna limit. Show responsible financial behavior by paying off your Klarna purchases within the agreed-upon timeframe.

4. Use Klarna Regularly

Using Klarna regularly and responsibly can demonstrate your ability to manage credit effectively. Instead of making one large purchase and paying it off immediately, consider making smaller purchases and paying them off over time. It can help Klarna see that you are a reliable and responsible borrower.

5. Gradually Increase Your Klarna Purchases

Another strategy to increase your Klarna limit is to gradually increase the amount of your purchases over time. Start with smaller purchases and consistently pay them off on time. As Klarna sees your responsible payment behavior, they may increase your limit to accommodate higher purchase amounts.

6. Be Patient and Persistent

Increasing your Klarna limit may not happen overnight. It requires patience and persistence. Continue to demonstrate responsible financial behavior, pay your bills on time, and manage your credit effectively. With time, Klarna may recognize your efforts and reward you with a higher limit.

7. Stay Informed About Klarna’s Policies

Lastly, stay informed about any updates or changes in Klarna’s policies. By keeping up-to-date with Klarna’s terms and conditions, you can make informed decisions and take advantage of any opportunities to increase your Klarna limit.

8. Consider Other Financing Options

If increasing your Klarna limit proves to be challenging, consider exploring other financing options available to you. You can avail of various alternative payment solutions and credit providers that may offer higher limits or more favorable terms based on your financial situation.

Key Takeaways

Increasing your Klarna limit is possible with the right strategies and sound financial habits. By paying your bills promptly and demonstrating responsible financial behavior, you can enhance your creditworthiness and potentially secure a higher Klarna limit. Remember to stay informed, be patient, and seek professional advice if needed.

FAQs

1. Is it guaranteed that my Klarna limit will increase if I follow the above tips?

While following the tips listed above can improve your chances of increasing your Klarna limit, it is not guaranteed. Klarna’s credit assessment process takes into account various factors, and individual results may vary.

2. How long does it take for Klarna to increase my limit?

The timeframe for Klarna to increase your limit can vary. It may take several months of responsible financial behavior and consistent usage to see an increase in your Klarna limit.

3. What happens if I exceed my Klarna limit?

If you exceed your Klarna limit, your purchase may be declined, or you may be required to pay the excess amount upfront. It is important to stay within your Klarna limit to avoid any issues.

4. Can I request a credit limit increase immediately after opening a Klarna account?

We recommended that you wait for a few months before requesting a higher credit limit. It allows Klarna to assess your payment behavior and financial stability over a reasonable period.

5. Will increasing my Klarna limit affect my credit score?

Requesting a credit limit increase from Klarna may result in a hard inquiry on your credit report, which can temporarily lower your credit score. However, responsible credit management and a higher credit limit can ultimately have a positive impact on your creditworthiness.