PayPal Holdings, Inc. is an American financial technology company that offers an online payment system worldwide. Their services include money transfers, making purchases, and an electronic alternative to conventional checks and money orders. PayPal is one of the most trusted online payment platforms that has been around since the earliest days of e-commerce. Recently, PayPal expanded its services to the buy-now-pay-later, like the Swedish fintech Klarna. Paypal launched a ‘Pay in 3’ service and became a direct player in the BNPL market.

Since PayPal became a competitor of Klarna, there has been a debate whether you can use them together. Yes, you can use your PayPal with your Klarna account, and here’s how:

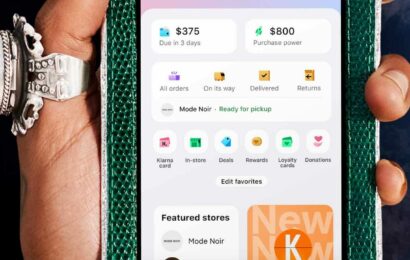

Step 1: On your PayPal account, go to Pay & Get Paid.

Step 2: Select Bank & Cards

Step 3: Tap Link a new card on the Cards section

Step 4: Key in your Klarna Visa Card information on the field (e.i., card number, card type, expiration date, CVV, and your billing address)

Step 5: Tap Link Card

Can I use Klarna to pay with Paypal?

There has been confusion about whether you can use Klarna to pay with your PayPal account or not. Several people had issues using Klarna with PayPal. There are reported instances wherein people got restricted on PayPal accounts for good, after using Klarna with PayPal. However, people in the PayPal community claim that Klarna works with PayPal to pay their purchases, specifically if a merchant uses PayPal for check out. Add the Klarna card to your PayPal account after creating a one-time card in the Klarna app, and payment will go through. One PayPal user even said that it is possible in some stores like Amazon. All you need to do is create a ghost card under Amazon, then type in the card details on PayPal, and it should work.

Whether you can use it or not, it is all up to you. There are other payment options on the line, like paying directly with your Klarna or paying with your PayPal account, which is less complicated than combining these two rivals.

Is PayPal pay in 4 like Klarna?

In 2020, PayPal Holding Inc. launched their first Buy-now-pay-later or ‘Pay in 4’ plans for their users. The launch of PayPal’s BNPL made PayPal a direct competitor of Klarna, which also offered a Pay in 4 short-term, interest-free installments. There are a few things to consider when choosing between PayPal and Klarna as your payment method, which are:

Sign-up process– Klarna offers an easy way to sign up, while PayPal is stricter and charges a small fee to verify your payment option. PayPal is also required to verify your identity by providing legal documents, while Klarna only requires a bank account before your first purchase.

Country Availability– Klarna is available in 17 countries, while PayPal has a global reach of 200+ countries.

Number of retailers –Klarna has more than 14,000 affiliated stores in the UK that offer a BNPL, while PayPal has millions of stores worldwide.

Returns– Klarna helps you throughout the process of returns. You can report your return through the app. With PayPal, once you return the item, the seller returns the money, which either goes to your PayPal account or to your bank account you used to pay.

Late Fees– Klarna doesn’t charge late fees. Klarna will try to collect payment twice and allow a 7 to 10 days extension. The app will restrict your purchasing access after ten days. On the other hand, PayPal charges up to $10 per missed payment, except for states, such as Mississippi, Pennsylvania, Delaware, Indiana, Maine, Arkansas, Oregon, and Maryland.

In conclusion, whether Klarna is better than PayPal depends on you. Either way, both businesses provide flexible payment options and can be trusted to handle your money.

Can I pay at Klarna.com with PayPal credit?

No, Klarna does not accept PayPal as payment. You cannot pay Klarna credit with a credit card nor transfer the PayPal Credit balance to Klarna. There are other options to repay Klarna. Klarna accepts most major debit and credit cards (i.e., Mastercard, Visa, AMEX, Discover). You can also set an automatic payment to repay your credit. Follow the steps below:

Step-1: Go to Klarna Payment Settings

Step-2: Connect a bank account

Step-3: Use your bank account and routing numbers to make an automatic payment on your credit account.

Step-4: Enroll in automatic payments

Can you add Klarna’s one-time card to Paypal?

Yes, you can add Klarna’s one-time card to Paypal. Right after you create a Klarna virtual card, log in to your PayPal account and go to Pay & Get Paid. Go to the Bank & Cards section and start linking one-time card details such as card number, card type, expiration date, security number, and billing address. Make sure that the merchant accepts Klarna and PayPal as payment options upon check out.