What is Account Services? What Do They Do?

Contents

According to the Urban Institute, 64 million Americans have debt in collections. If you are a member of this not-so-exclusive club, you may have received a call or ten from Account Services Collections Incorporated. What is Account Services? Read on to find out.

Account Services Collections Inc., also trading as Account Services USA, is a debt recovery company based out of San Antonio, Texas. Given the nature of its business: demanding money from people who don’t have much to begin with, it isn’t a popular company.

Who is Account Services and why are they calling you?

Account Services is a collections company. If they call you, it means you owe somebody money and your payment is overdue by at least 60 days. It can be a hospital bill, a credit card bill, unpaid rent, an electricity bill, or any number of other bills.

Whom does Account Services Collections collect for?

Account Services collects for everyone who can pay them. Hospitals, dentists, credit card companies, payday lenders, phone companies, and utility providers among many others. If you have unpaid bills somewhere, the odds are that the debt owner will hire Account Services USA or some other collections agency to pursue repayment. Unpaid bills are often declared delinquent after 60 days of non-payment.

The debt collection business model

Delinquent debt is categorized according to the odds of repayment. The longer a debt remains unpaid, the lower the chances that it will ever be repaid and the less valuable it is.

Debt collectors make money by taking a commission on all the money they manage to recover for their clients or by buying the debt outright for pennies on the dollar and then keeping whatever they can squeeze out of debtors.

For example, you go to a dentist and get some work done for $7,000. You pay off $2,000 but due to financial difficulties, are unable to repay the $5,000 balance.

Either because he lacks the manpower or the will to call each of his non-paying clients every morning and demand that they pay him, the dentist outsources this work to collections agencies like Account Services. They will be the ones calling you in pursuit of payment. If they manage to collect the money, the dentist pays them a commission. However, if they don’t, they’re out of luck.

If you still haven’t paid the balance at the end of a certain period, the dentist might decide to cut his losses and sell your 5,000-dollar debt to someone else for say $200. $200 is pretty standard as debt buyers commonly pay around five cents for each dollar owed in the case of delinquent debt. The value can be higher for mortgages and debts like unpaid rent or utility bills.

Once in possession of this debt, the new owner can then pursue repayment in full and keep every penny. Some will settle for half the amount owed or even a third. It’s still profitable for these debt buyers to collect 30-40% of a debt’s outstanding balance given that they bought the debt at 5% of its book value.

Where Account Services Come in

Account Services represents both the original creditors (the dentist in this example) and the secondary debt buyers.

The company also buys delinquent debt from creditors like healthcare providers and financial institutions and then pursues independent repayment. If you see Account Services on your credit report despite never having borrowed money from them, it means the company bought your debt from the original creditor.

Debt buying is a logical expansion niche for debt collectors because they already have experience pursuing delinquent debt and know what the repayment rates are.

Say, for example, a collection agency like Account Services buys a portfolio of 100 loans totaling $200,000. For simplicity’s sake, let’s say each debtor in the portfolio owes $2,000. At five pennies on the dollar, they would pay $10,000 for this portfolio of unpaid loans. Once in possession of the debt, Account Services only needs to convince five of the 100 debtors to pay their loans in full to break even. These figures are all hypothetical. Debt buyers and collectors are very tight-lipped about the repayment rates of delinquent debts but if it was an unprofitable business, no one would engage in it.

Who owns Account Services Collections?

Account Services Collections Inc. is a family business founded in the early 1970s by Richard Goforth. The company is currently run by its president Rick Goforth (Richard’s son) and Julie Goforth, the Vice President of Operations.

Little is known about the internal workings of the company. You won’t find significant information through the LinkedIn profiles of Rick, Julie, and Chris Goforth, its highest-ranking officers. Their Facebook profiles show standard boomer content filled with family pictures and birthday messages. Julie Goforth also runs Pink Happy Tails Transport, a dog transport company.

Account Services Collections employs 44 staff and brings in an estimated $3.4 million in annual revenue.

Account Services Collections FDCPA violations

Debt collection in the United States is regulated by the Fair Debt Collection Practices Act (FDCPA). The law is meant to protect clients from overly aggressive tactics employed by debt collectors in an attempt to pressure debtors into paying.

According to the FDCPA, a debt collector cannot:

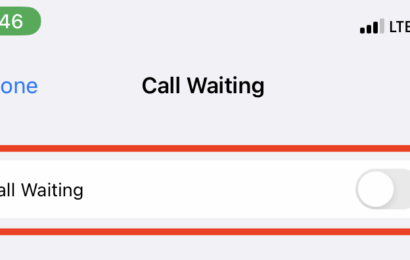

- Contact you before 8 am and after 9 pm.

- Call you at work.

- Contact you directly if you have a lawyer representing you.

- Contact your employer, friends, or relatives in an attempt to shame you.

- Press for the payment of a debt that has been discharged either through a settlement or bankruptcy.

- Contact you after you tell them not to – yes, you just tell them not to call you again. This should be done with a cease and desist letter sent via snail mail or email. It ceases communication but doesn’t stop the debt collector from pursuing other avenues of repayment like lawsuits.

Seeing as following the letter of the law would make work very hard for debt collectors like Account Services, it’s no surprise that they have been caught violating the FDCPA on multiple occasions. Harassment is the number one complaint filed against debt collectors and Account Services is no different. The company has been sued for harassment and the pursuit of debts that have either been settled or otherwise discharged.